You rely on accountants to ensure that your financial audits are thorough and fraud prevention is effective. An accountant in Missouri City, TX, with experience in these areas, can help safeguard your organization’s finances. They catch discrepancies. They spot suspicious activities. They prevent financial misconduct before it happens. Why does this matter? It’s simple. Unchecked fraud can devastate your business. Financial audits, conducted by skilled professionals, ensure accuracy, transparency, and trust. These accountants have a sharp eye for detail. They navigate complex financial data with ease. They protect your bottom line. You’ll benefit by having a trusted partner who understands your financial landscape. Ultimately, you want peace of mind. You deserve to feel confident in your financial practices. By engaging with a qualified accountant, you strengthen your defenses against fraud while ensuring compliance with regulations. This proactive approach can save you stress, time, and money.

Role of CPAs in Financial Audits

Financial audits are not just routine checks. They are essential for verifying your organization’s financial health. CPAs play a critical role in these audits. They verify the accuracy of financial statements. They ensure that your financial records comply with laws and regulations. They identify and rectify errors.

Since CPAs have a deep understanding of accounting principles, they can provide valuable insights. They not only check the numbers but also the processes behind them. CPAs offer suggestions to improve financial practices. This ensures your organization is on the right path.

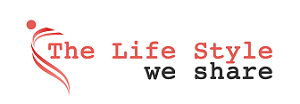

Fraud Prevention: A Key Responsibility

Fraud can occur in any organization. It can start small but grow into a significant issue. CPAs act as vigilant watchdogs. They identify vulnerabilities in your financial systems. They recommend controls to prevent fraudulent activities.

Moreover, CPAs conduct risk assessments. They evaluate where your organization is most at risk. They help implement systems to monitor and catch fraud early. You safeguard your assets and reputation by working with a CPA.

Steps in a Financial Audit

Understanding the steps in a financial audit can help you appreciate the CPA’s role even more. Here is a simplified breakdown:

- Planning phase: Understand the organization and assess risks.

- Fieldwork phase: Gather evidence and test transactions.

- Reporting phase: Summarize findings and provide recommendations.

Each step requires the CPA’s expertise and attention to detail. They leave no stone unturned to ensure the integrity of your financial data.

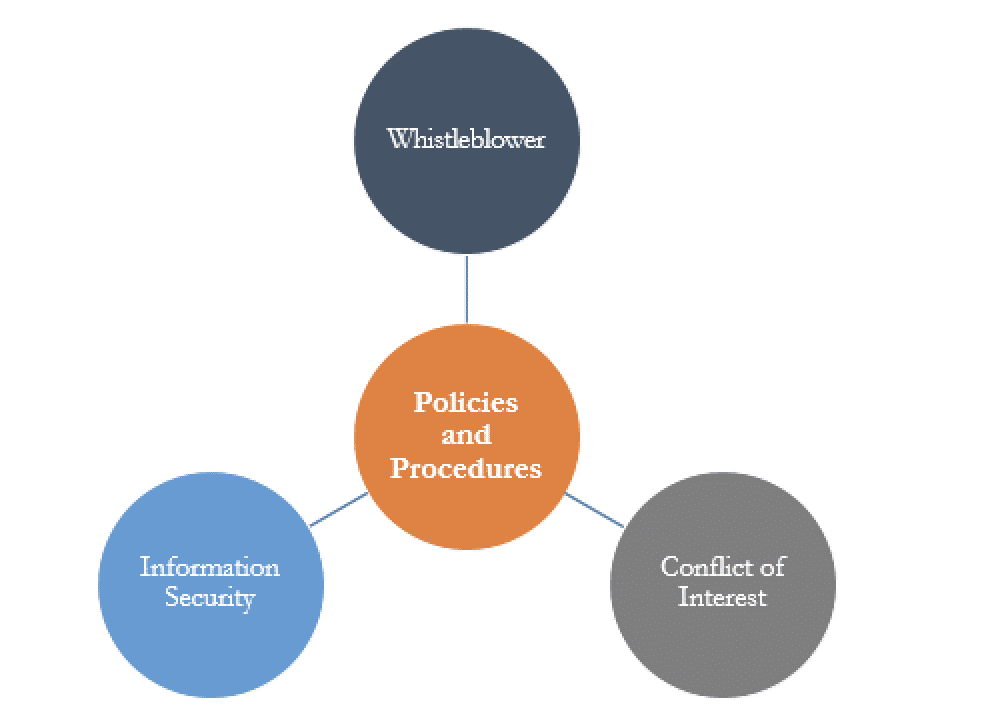

Fraud Prevention Techniques

CPAs use various techniques to prevent fraud. Here are three key strategies:

- Internal controls: Establish checks and balances within the organization.

- Regular audits: Conduct frequent audits to catch irregularities early.

- Employee training: Educate staff about ethical practices and fraud awareness.

These techniques form a robust defense against potential fraud, protecting your organization from financial harm.

Comparison Table: CPA vs Non-CPA

| Criteria | CPA | Non-CPA |

|---|---|---|

| Certification | CPA License | No License |

| Expertise | High | Variable |

| Fraud Detection | Proficient | Limited |

| Financial Audits | Authorized | Not authorized |

The Value of CPA Services

Engaging a CPA offers numerous benefits. You gain access to a wealth of knowledge and experience. They provide clarity in financial reporting. They enhance accountability within your organization.

CPAs are bound by ethical standards. They maintain confidentiality and work in your best interest. You can trust their guidance and rely on their expertise.

According to the U.S. Securities and Exchange Commission, regular audits and financial transparency are crucial for businesses. A CPA helps you achieve both objectives effectively.

Final Thoughts

Financial audits and fraud prevention are crucial for healthy business operations. A CPA is your ally in this process. They bring knowledge and diligence to your financial practices. Their role extends beyond numbers. They offer peace of mind as you focus on growing your business.

Consider engaging a CPA to assist with your financial audits and fraud prevention. The investment is worthwhile for your organization’s long-term success.