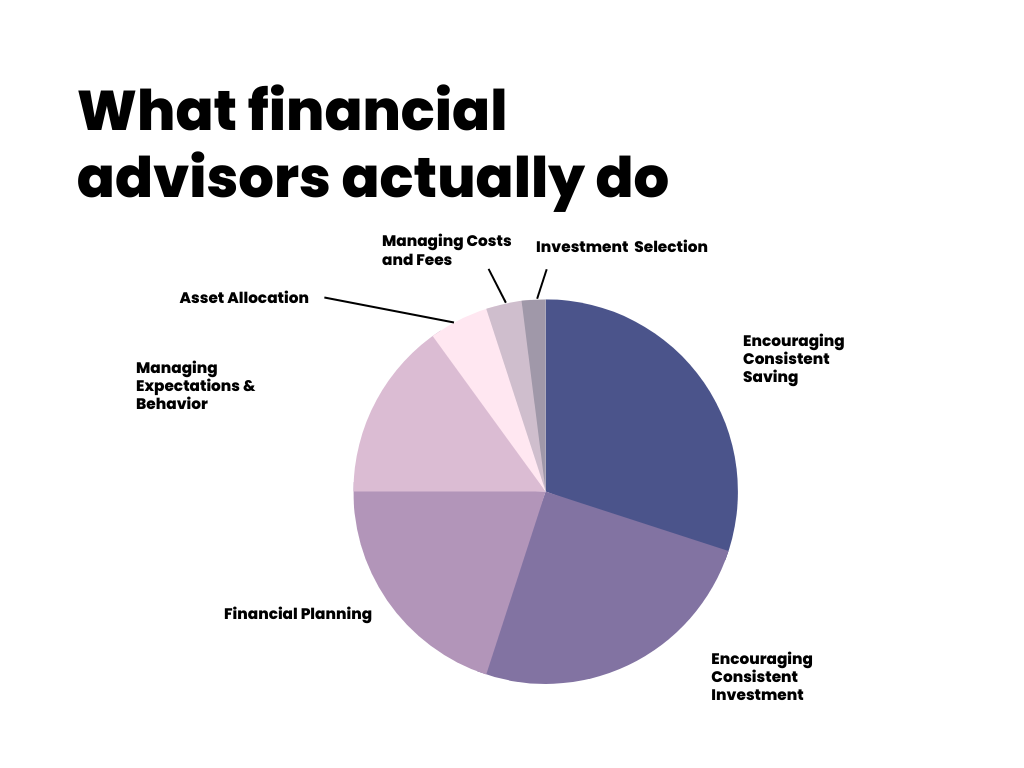

Understanding what a financial advisor does can lift the fog of uncertainty around money management. You may wonder how a certified financial planner in Katy, TX, can help in your financial journey. Financial advisors guide you in making informed decisions with your money. They help you focus on your financial goals, whether saving for retirement or managing debt. They offer clear advice in budgeting, investing, and planning for future needs. With their expertise, you can navigate the complexities of taxes and insurance. Think of them as your financial coach. They motivate and educate you, ensuring your financial health improves over time. They provide a personalized plan tailored to your financial situation. You don’t face financial challenges alone. A skilled advisor stands by your side. This guidance is not just for the wealthy. It’s for anyone looking to secure their financial stability and peace of mind.

Your Financial Blueprint

Financial advisors start by crafting a roadmap for your money. This plan outlines how to save, invest, and spend wisely. They assess your current financial health by looking at your income, expenses, and debts. Then, they help set realistic financial goals. These goals could involve buying a home, paying for education, or retiring comfortably. Advisors offer strategies to reach these milestones, breaking down large goals into manageable steps.

Investment Guidance

Advisors simplify the investment process. They identify the best investment options for you based on your risk tolerance and timeline. They explain the pros and cons of stocks, bonds, mutual funds, and other vehicles. With a clear strategy, your investments align with your long-term objectives. Advisors continuously monitor your portfolio, suggesting adjustments as needed to keep you on track.

Managing Risks

Financial advisors help you understand and manage risks. They review your insurance needs, ensuring you have adequate coverage. This includes health, life, and property insurance. Proper coverage protects your assets and provides peace of mind. Advisors also address risks related to market fluctuations and economic changes, keeping your investments safe.

Planning for Taxes

Taxes can be complicated, but advisors make them manageable. They identify tax-saving strategies and ensure you take advantage of available deductions and credits. By planning for taxes, you keep more of your hard-earned money. Advisors also guide you through changes in tax laws, ensuring compliance and optimizing your tax situation.

Retirement Planning

Retirement planning is crucial. Advisors help you determine how much you need to save for a comfortable retirement. They suggest suitable retirement accounts like IRAs or 401(k)s and help you maximize contributions. By planning early, you set yourself up for a secure and stress-free retirement.

FAQs About Financial Advisors

| Question | Answer |

|---|---|

| How do advisors get paid? | Advisors earn through fees, commissions, or a combination of both. Ask for a clear explanation of their fee structure. |

| When should I consult an advisor? | Consider consulting an advisor when facing major financial decisions or life changes. |

| Are all financial advisors certified? | Not all advisors hold certifications. Look for certifications like Certified Financial Planner (CFP) for expertise assurance. |

Choosing the Right Advisor

When selecting a financial advisor, consider their qualifications and experience. A Certified Financial Planner (CFP) designation ensures they meet high standards of education and ethics. Check their history for any disciplinary actions. Personal compatibility also matters. You should feel comfortable discussing personal financial matters with them.

Conclusion

Financial advisors play a crucial role in guiding you through financial decisions. Their expertise in creating plans and offering advice is invaluable. Whether you are just starting or preparing for retirement, they provide clarity and direction. Understanding their role helps you make informed choices. With the right advisor, you confidently face financial challenges, ensuring stability and peace of mind. For additional resources on financial planning, explore the insights from Consumer Financial Protection Bureau.